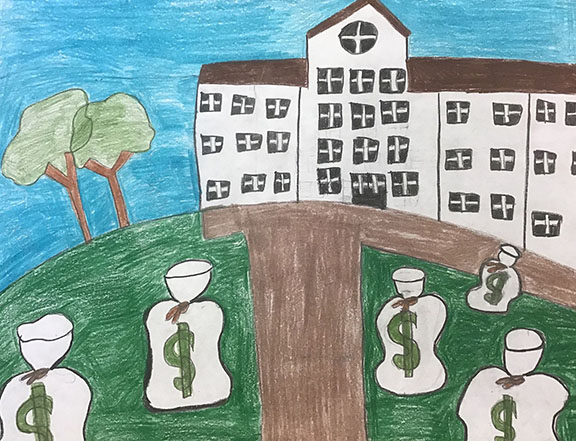

Student loans for life?

College sounds great to the outsider: free time, a beautiful environment, housing, endless activities and clubs and an education designed to last a lifetime of prosperity. However, these luxuries come with a hefty price tag. The average tuition in Illinois has come to be $13,620 for an in-state resident and $23,480 for out-of-state, and a private institution will leave someone with $34,740 out of their pocket every year. Thankfully, there is a solution that permits all prospective students to attend college: federal loans and financial aid.

The price of college and the increased amount of enrollment in higher education has had a detrimental causation to the reliance on federal loans to pay tuition. Since it is difficult for students to work during the year, the debt accumulates with added interest. The total student debt is currently $1.6 trillion, exceeding the total car loan and credit card debt, according to Harvard Business Review. However, that number does contain a wide demographic. According to Forbes, only 8% of all borrowers owe more than $100,000. Graduate students tend to be the ones with the most debt since they essentially went to school twice. However, these students pay back their loans more easily because they work in high-paying jobs as a result of their distinguished degree and prowess in that area of expertise. Borrowers that owe less than $5,000 often default the most because they are most likely not making enough after college due to an insufficient degree or they have troubles financing their loans well.

With the accumulation of this massive student debt, problems have begun to arise economically for the country. People right out of college are spending less on houses and consumer goods because they have to spend that money to pay back their loans. This harms the market and overall economy because there is less money movement in the business realm because it is directed towards the federal government. In long-term cases, the lack of savings will hurt retirement for these people because they are unable to set aside money early. This will cause more reliance on social security as well.

Current presidential candidates see this issue as a way to gain support. Bernie Sanders has proposed a plan to completely eliminate and forgive all student debt by taxing the wealthy. According to NPR, this plan would require $2.2 trillion because it makes all public education free as well. This could result in a better economy and a safer future for the borrowers of the United States. However, by eliminating all debt, the racial wealth gap may increase because the people who owe the most can make that money back, and the people who struggle the most with student debt are often low-income African Americans. If we were to develop a plan that would eliminate student debt, I think it should be targeted towards the students with the <$10,000 range because it would cost less, and it would avoid the growth of the racial wealth gap. Even so, skeptics believe that with the massive forgiveness of student loans, college applicants would be more likely to take out loans and colleges to inflate their prices.

According to NPR, there are plans such as the system of income-driven repayment where loans are capped on a certain student’s income and can be forgiven at the end of a 20- or 25-year period. However, these programs are not well understood or even known about by borrowers or the general population.

Overall, the student debt crisis is not something that can be solved easily or completely, since a $1.6 trillion debt is going to have an effect on the economy regardless. Despite this, I think that there are actions that can be taken by individual students and institutions to limit the amount of debt for graduates. Firstly, schools should add a cap to the amount of financial aid and federal loans that someone can receive. If one can only take out a certain amount of money, it limits the amount of debt and how much someone has to pay back. Secondly, students should be educated on the subject or have an economic advisor to make sure they will be able to make enough outside of college to sufficiently pay back their loans. Otherwise, students may have to take another career path. The student loan crisis must begin with the student and the school because sometimes it might be too late to reverse the effects.

Your donation will support the student journalists of Saint Viator High School. Your contribution will allow us to purchase equipment and cover our annual website hosting costs.